Organisations of all sizes, and from all sectors, are under increasing pressure to reduce their carbon emissions and overall environmental impact. As the need to tackle climate change intensifies, governments and regulatory bodies around the world are stepping up their reporting requirements and targets. This is particularly the case for organisations in emissions-intensive sectors like resources, transport, manufacturing, construction and agriculture.

The administrative load is increasing significantly too, with organisations now expected to capture, analyse and report on their emissions at a far more granular level than ever before. In addition to tracking emissions, new standards and requirements require disclosures on a range of indicators including greenhouse gas emissions, use of hazardous materials, water and energy consumption, pollutants, impact on the natural environment, the carbon footprint of products, and more.

This information isn’t just mandated by regulatory bodies and climate change authorities. It’s also sought by potential investors, customers and employees who are looking to make more sustainable choices in terms of who they partner or work with.

Yet many large organisations are still relying on Microsoft® Excel® spreadsheets and manual updates to capture, analyse and report on their emissions and other sustainability indicators—which can increase the risk of error and inefficiency.

In this guide we will highlight the growing complexity of sustainability requirements, and the crucial importance of automating reporting and compliance. We will also provide an outline of the current requirements; shed a light on some of the top reporting-related challenges facing businesses; highlight the shortfall of using Excel spreadsheets, and explain the vital importance of implementing a robust digital solution for your carbon accounting and reporting.

In this article:

- #1 Global emissions targets: we need to increase our efforts

- #2 The requirements: an overview of legislative and regulatory sustainability requirements for businesses in 2024.

- #3 Where does responsibility for reporting lie?

- #4 The challenges: key factors inhibiting timely, accurate and effective reporting

- #5 Why using Excel elevates your reporting risk

- #6 Why a digital platform is the only way forward

- #7 What to look for in a digital platform/solution

- #8 The benefits of a robust digital sustainability reporting solution

- #9 How Sustainability Tracker offers a solution

- #10 From Excel to Sustainability Tracker: How to make the shift

- Start your transition to best practice sustainability reporting today

- About the Authors

- References

#1. Global emissions targets: we need to increase our efforts

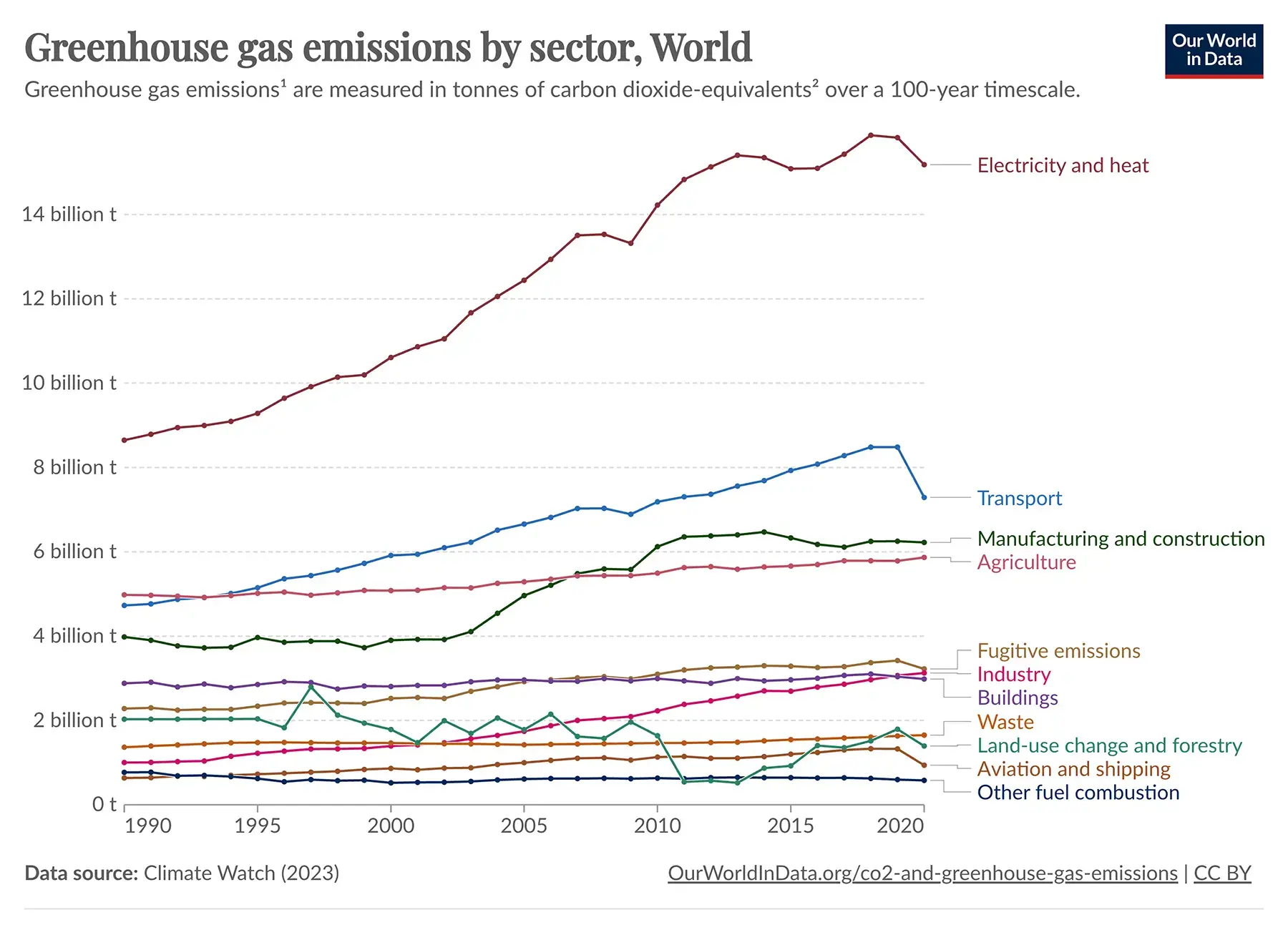

In December 2023, world leaders gathered in Dubai for COP28: the United Nations Climate Change Conference. The outcome from this event was clear: while progress towards decarbonisation is happening, more ambition and focus is needed if we are to limit global warming to 1.5˚C – the revised goal of the Paris Agreement.1 Studies show that while emissions are no longer increasing, compared with 2019 levels, they are not indicating the downward trend which scientists say is crucial for this decade.2

Note: This graph has been copied without amendment, and remains the property of Our World in Data (www.ourworldindata.org).

As Figure 1 above demonstrates, the world’s highest emitting sectors include transport; manufacturing and construction; agriculture; fugitive emissions; industry; buildings; waste; land-use change and forestry; and aviation and shipping.

For organisations in these emissions-intensive sectors, the pressure to meet regulations—and actively reduce emissions—is particularly significant.

#2. The requirements: an overview of legislative and regulatory sustainability requirements for businesses in 2024

For all businesses, the list of regulations and requirements relating to sustainability is constantly evolving. It can also differ considerably from industry to industry, and based on the size of the business and its location. Following is an overview of some of the key regulations currently in place, or soon to be implemented.

International Sustainability Standards Board (ISSB) Standards

On 1 January 2024, the International Sustainability Standards Board (ISSB) released rigorous new standards. It is now up to individual jurisdictions to determine if (and how) they will incorporate these standards into national law, or if companies should adopt the standards voluntarily.

These standards build on those which have already been set by the Task Force on Climate-related Financial Disclosures (TCFD) framework. The recommendation is that organisations across a range of industries report on climate-related factors—to a granular level that is far more detailed than currently exists in jurisdictions.

It’s important to note that at COP28, in December 2023, close to 400 organisations from 64 jurisdictions joined multilateral and market authorities to commit to advancing the adoption of the ISSB standards.4

EU’s Corporate Sustainability Reporting Directive (CSRD)

These European standards are active as of 5 January 2023, and require a broader set of large companies, as well as listed SMEs, to report on sustainability. The first companies will have to apply the new rules for the first time in the 2024 financial year, for reports published in 2025.5

Under these standards, European member states must incorporate the provisions of the CSRD into their national law. This also affects overseas companies which operate in Europe. The regulations require organisations to provide very thorough and accurate detail regarding their ongoing sustainability performance, and how they are tracking towards targets.

Biodiversity, Ecosystems, and the Taskforce on Nature-related Financial Disclosures (TNFD)

This framework requires organisations to disclose data concerning the risks and opportunities associated with biodiversity decline. These risks may include disruptions to feedstock access or vulnerability to extreme environmental conditions. Disclosure of such data is required, even if the risks do not directly impact the company’s financial standing. On 16 January 2024, the TNFD announced that 320 organisations from over 46 countries have committed to start making nature-related disclosures. These will be based on the TNFD recommendations published as part of their annual corporate reporting which spans FY2023, FY2024 and FY2025.

Carbon Border Adjustment Mechanism (CBAM)

Enacted as part of the European Green Deal, the Carbon Border Adjustment Mechanism (CBAM), also known as the ‘carbon border tax’, imposes a new tariff on a variety of carbon-intensive products imported into the European Union (EU). The CBAM assigns a value to carbon-intensive products upon their entry into the EU, considering direct emissions (scope 1), as well as indirect emissions stemming from electricity consumption and other sources (scope 2 and, more recently, some scope 3 emissions). As part of the CBAM, EU entities will request organisations which are exporting goods to the EU to furnish information regarding the carbon emissions associated with the imported goods.

Securities and Exchange Commission (SEC) requirements

Sustainability-related information is playing an increasingly important role in investment decisions. For this reason, the US Securities and Exchange Commission has proposed a range of rule changes which are due to come into force for larger organisations in 2024 (and for smaller companies in 2025).

Under the changes, companies will be required to disclose specific climate-related information. This could range from their greenhouse gas emissions, to any foreseen climate risks, and details of how they plan to achieve greater sustainability. The overall aim is that investors will have consistent and comparable information to back-up any investment decisions.

This article includes a more detailed explanation of these regulations.

#3. Where does responsibility for reporting lie?

In many organisations, there can be a lack of clarity around who is responsible for the organisation’s sustainability accounting and reporting—or for overall environment, sustainability and governance (ESG) performance. While many larger organisations have established ESG teams, employing Chief Sustainability Officers, the reality is that reporting often becomes a function of the finance team.6

According to a recent report most organisations are still in the early phases of defining roles and responsibilities to support reporting efforts.7 As a result, responsibility for ESG reporting can also end up divided amongst the C-suite, including the Chief Executive Officer, Chief Information Officer, Chief Compliance Officer, Chief Operating Officer and Chief Marketing Officer.8 The report also reveals that finance teams anticipate spending more time and resources to address ESG data collection and governance over the next 12-18 months, and that a major challenge for organisations will be assigning responsibilities to different data owners.

“Many companies have significant work to do as they continue to work to construct governance structures to foster efficient ESG reporting internally and externally,” the report says.9

To move forward effectively, it’s imperative that organisations put some clarity in place regarding reporting—accurately defining roles and responsibilities. This will require a whole-of-business approach.

#4. The challenges: key factors inhibiting timely, accurate and effective reporting

For many organisations, there are several key factors which currently inhibit their ability to accurately report on their emissions and sustainability indicators. These can include:

Lack of consolidated data

As intensive sustainability reporting is a relatively new requirement, many organisations simply don’t have the centralised systems or processes in place to support it. The task can therefore be cumbersome and overwhelming. The volume of data which is now required by regulators is fast and ever-growing, with data residing in disparate applications and systems—all of which needs to be pulled together, cross-referenced, and analysed.

In a recent survey, 60% of respondents indicated that ESG information is a “patchwork” of software applications, and 55% of respondents said they are housing their ESG data in spreadsheets.10 Just 8% of respondents indicated that they have a relatively complete set of procedures in place to drive consistent application of ESG data across the organisation.11

In many organisations, it is currently very difficult to reliably and efficiently pull together the complex data required for ESG reporting.

Increasing importance of ESG data

Sustainability-related data is now not just about meeting regulatory requirements. It’s also being used for a multitude of functions—including to market the organisation’s sustainability credentials to employees, investors and partners. This adds a new level of complexity and detail to the information which organisations must collate and measure.

A recent report reveals that in 75% of organisations, the audit committee or other board committee had asked about policies and procedures for ESG reporting. This is an indication that many companies appear to be determining whether current policies and procedures are sufficient for information to be used in financial filings, or even voluntarily via other avenues.12

Overly manual, ad-hoc processes

In addition to siloed and disparate data, another major problem many organisations face is the overly manual way in which data is collected, collated and analysed. This is particularly the case when it is being pulled together from disparate systems. In a recent survey, the majority of respondents indicated that they were relying on incomplete or not yet fully developed policies and procedures for their ESG reporting.13

“It’s certainly not uncommon for the processes surrounding ESG reporting to be ad-hoc,” says Vagenas. “Data will often be manually reviewed and checked, copied and pasted. In some instances, we’ve even seen people calling in the data over the phone, or pulling it together from emails.”

Limited data capture

Another major challenge many organisations face is that they are limited in terms of the data they can capture and collate. According to recent research, ‘Scope 3’ emissions, which are the greenhouse gases generated outside of a company (but still within its value chain), actually comprise around 88% of a company’s emissions. However, because they are beyond the company’s operational reach, they can be extremely hard to capture, analyse and include in reports.14

As a result, most companies are only capturing data on Scope 1 and Scope 2 emissions—which does not provide an accurate or comprehensive picture.

Lack of clear reporting requirements

The legislation and governance requirements surrounding sustainability reporting is also changing so quickly that it can be hard for organisations to get a grasp of what needs to be reported. With the goal posts changing so frequently, it’s also hard for organisations to create a very clear and accurate set of KPIs to measure progress.

“When companies report on a variety of KPIs that assess ESG performance from different angles, it becomes harder for leaders to execute. Executives say that regulatory barriers and inconsistent standards are two of the top challenges holding ESG efforts back,” claims a recent article.15

As we discuss in this Sustainability Reporting article, however, things are changing. Efforts are being made on a global scale to improve clarity around reporting requirements. For organisations, the challenge will be choosing a reporting solution that can automatically adhere with these ever-evolving requirements.

Lack of digital technology

A major challenge for sustainability reporting is that organisations lack robust tools to track and measure progress. Many also lack the time, resources, and expertise to select a reliable and best-in-class technology platform that can support effective reporting. Only 45% of organisations in a recent survey said they had tools and software to facilitate a review process around ESG information.16 To add to this, only 48% of organisations have the tools integrated into their financial technology, or would like them to be.17

#5. Why using Excel elevates your reporting risk

Despite the increasing importance of sustainability reporting, many organisations are still overly reliant on manual solutions—primarily Excel spreadsheets—for critical measurement and analysis.

“Many organisations that we work with still rely on Excel spreadsheets, with manual inputs and disparate data sources,” says Vagenas. “Despite the fact that most organisations are committed to digital transformation, there is a reluctance to making technology decisions that move away from legacy processes. As a result, many businesses are still using manual spreadsheets and methods to fulfil immediate reporting requirements. This process is very error prone, slow, costly and can expose the businesses to significant risk,” he adds.

While organisations know they need to be able to calculate sustainability indicators at a granular level and consolidate this up across all their sites, most simply don’t currently have digital solutions in place, specific to their requirements, to calculate this data accurately and transparently. They know their data is convoluted or flawed, yet don’t know how to start moving away from the spreadsheets they have always used.”

According to a recent survey, organisations’ inability to measure accurately and exhaustively is a major blocker to effective carbon reporting.

While 85% of organisations are concerned about reducing their greenhouse gas emissions, and 96% have set targets for reducing emissions in at least one scope, only 11% have actually managed to cut their emissions in line with their ambitions over the past five years.18

According to this survey:19

- Just 9% of companies measure their total emissions comprehensively.

- 81% confess to omitting some of their internal (scope 1 and 2) emissions.

- 66% of organisations do not report any of their external emissions.

- There is an average error rate of 30 – 40% in emissions measurement.

- 49% of respondents identified granular operating data as “hard” or “very hard” to find.

- 55% of respondents identified granular emissions factors are “hard” or “very hard” to find.

“If companies don’t have complete and high-quality emissions baselines, how can they analyse their current footprints, designate appropriate targets, design the right initiatives, and, ultimately, track the results?”, the report suggests.

Using Excel spreadsheets is problematic from an ESG reporting point of view for several reasons:

Data can be manipulated or altered

Formulas and data within an Excel spreadsheet can be modified at any time, without a trace, and anonymously – affecting data accuracy. Reports are usually generated by manually typing or copying and pasting data into various worksheets with links to other workbooks, and there is typically little or no integration between different types of source data.

Poor compliance

Producing quality ESG reporting requires accuracy and auditability at every step of the process. Excel documents are also not typically traceable nor auditable, and anyone can change or manipulate data, meaning they lack compliance with many regulatory requirements.

Lack of automation

Spreadsheets are also not typically connected to source data, which means data must be inputted manually. Data must be tracked down and collated from various sources, and may even require metric conversions across regions. Excel can also be cumbersome and time-consuming, have potential version control issues, and be slow to process data.

Knowledge retained within a limited team

Often, knowledge of how to operate an Excel spreadsheet system is retained by only a certain number of people within the business – posing problems for scalability and growth. If an expert is away, or leaves the organisation, it can also require extensive re-training and inefficiency.

Risk of data loss or corruption

When you are using multiple spreadsheet users concurrently, you also run the risk of version control, or that files won’t be backed up correctly. You can also end up with multiple copies of the same data files— with varying data— which can impact reporting accuracy. There is no debugging capability, and no way of instantly knowing if and where an error has occurred. If the wrong figure is accidentally entered into a particular cell, or there is an unknown issue with a formula calculation, it can render the analysis or reporting completely incorrect, which can have very far-reaching consequences.

Lack of insight

A major limitation of Excel is that it’s not inherently an emissions benchmarking or ESG tool and can’t provide your organisation with detailed insights on its performance. This makes it hard to drive meaningful change and identify areas for improvement. Formulas can also be potentially subjective and there is no clear reporting dashboard for stakeholders to instantly see the insights they need.

Inflexibility

A sustainability reporting solution that’s been developed in Excel will also lack scalability. Even if Excel is working for your organisation now, that doesn’t mean it will work in a year’s time – especially if the regulations and requirements continue to expand and gain complexity. This makes it hard to see and measure ongoing improvement.

Limited data volumes

The volume of sustainability-related data within a typical industrial organisation can be very complex, multi-faceted and ever-growing. Truly accurate reporting will require analysis of data volumes that extend well beyond the scope of a standard spreadsheet.

No machine learning or artificial intelligence

Spreadsheet cannot typically generate automated insights and rely on interpretation of data by specialists.

#6. Why a digital platform is now the only way forward

The opportunity to streamline and optimise ESG reporting with a digital solution is clear. Approximately 76% of executives now view ESG as central to their business strategy, and 72% see it as a revenue enabler rather than a cost-centre.20

To tap into this opportunity, moving away from Excel spreadsheets—and towards a robust digital reporting solution— is crucial.

According to the World Economic Forum, if brought to scale, digital technologies could reduce emissions by 20% by 2050 in the three largest emitting sectors. These industries can already reduce emissions by 4-10% by quickly adopting digital technologies, their research reveals.21

#7. What to look for in a digital solution / platform

When looking for a suitable platform, it’s important to look for several key factors:

Support for extensive, high-quality data

The amount of data relating to ESG is growing constantly: any quality sustainability reporting system must be able to capture and process huge volumes, in near real-time. The solution should be able to capture, process and analyse this data dynamically – without delay or manual intervention. Data should also be centralised and pulled, automatically, from whatever relevant systems the organisation has in place.

Measurement of Scope 1, 2 and 3 emissions

In addition to measuring scope 1 and 2 emissions, it’s also essential that any solution you choose is able to capture, analyse and measure data from Scope 1, 2 and 3 emissions. This means capturing data from both within your organisation, and across your supply chain.

Mass and energy balance

For industrial processes it is necessary to perform a mass and energy balance using dynamic simulation to reconcile delivery, consumption, inventory and production activity data. The simulated data contextualises measured activity data and can close any data gaps. It can also measure inventory using time as a dimension. Access to granular data means your sustainability indicators are complete, accurate, audible and can be reported down to a product level and across any sustainability reporting framework.

Predictive insights

Your solution should also allow you to accurately set budgets, targets and forecasts for greenhouse gas emissions, as well as your power and water consumption and other sustainability metrics. You should also be able to test scenarios to see how changes to your process operations. With accurate data on when, where, and why the business is using energy, it’s possible to then optimise consumption and reduce emissions and your environmental impact and costs without impacting business as usual.

Integration with other business systems

To deliver meaningful results, your solution also needs to be integrated with the rest of your business’ data—a seamless part of the business’ core functions, processes and existing workflows.

According to a recent report, “companies pursuing value-driven sustainability must look for change opportunities that will create a ripple effect. Their view should cut across traditional functional silos and processes—unlocking opportunities for rapid improvement at scale.”22

Cyclical insights

While adhering to regulatory requirements is crucial, organisations also need the capacity to use their data to drive improvement. A quality digital solution will provide insights that can flow back through the organisation to drive ongoing reductions and efficiencies.

#8. The benefits of a robust digital sustainability reporting solution

In addition to meeting compliance and reducing emissions and environmental impact, a robust digital ESG solution can also help organisations to:

Unlock operational efficiencies

With the right data at hand, organisations can rapidly identify opportunities for improvement, streamlining and cost reduction —for instance, by reducing energy use, or achieving the more efficient use of other natural resources.

Enhance decision making

Leaders can also more effectively cope with change and the increasing scope of regulatory requirements by testing future scenarios, and underpinning decisions with accurate data. A robust digital solution means less guesswork and more accurate decision-making in line with the organisation’s goals.

Gain unexpected insights

As well as the insights to do with ESG reporting, a powerful digital tool—when integrated with the rest of the business—should also be able to provide other insights to inform broader decision-making. The right technology will provide stakeholders with powerful insights at a glance, and instantly identify opportunities for improvement or innovation —both short and long-term.

Drive competitive advantage

By demonstrating sustainability status and improvements, organisations can establish a strong competitive advantage: making themselves more attractive to investors and partners. Research indicates that ESG data and capability leaders are 43% more likely to outperform their peers on profitability.23

Attract and retain employees

Enabling organisations to showcase their sustainability compliance—and progress—can also have broader benefits in terms of employee attraction and retention. More than 7 in 10 employees say they would be more willing to apply for a job with a company they consider environmentally sustainable or socially responsible.24

Grow and scale

The right digital solution should also give the organisation the ability to scale their sustainability reporting and activity in line with changes in the market, as well as rapidly adapt to new business models, partnerships or markets.

#9. How Sustainability Tracker offers a solution

Created to help organisations in monitoring, evaluating, and disclosing their sustainability footprint, Sustainability Tracker (ST) is a validated cloud-based Software as a Service (SaaS) solution. It functions by digitally replicating your organisation, conducting a full mass and energy balance through your asset, and provides detailed insights and thorough analyses spanning various sustainability metrics to adhere to evolving global standards. ST is a multifaceted platform, encompassing scopes 1, 2, and 3, alongside water usage, energy consumption, air purity, waste management, hazardous materials, and ecological risks.

At its foundation lies cutting-edge 4.0 technologies, encompassing big data utilisation, machine learning algorithms, dynamic simulation capabilities, Internet of Things (IoT) integration, multidimensional databases, and sophisticated analytical and visualisation tools.

ST is an industry-tailored, customisable solution, featuring a mass and energy balance computation engine crafted explicitly for sustainability reporting within industrial contexts. This engine ensures the accuracy and contextualisation of data, interfacing with other systems to present a comprehensive sustainability overview across industrial assets. This powerful digital solution also provides you with the capability to capture and report data directly associated with the specific industrial asset it is deployed in, inclusive of scope 3 emissions.

Sustainability Tracker can support the following:

- Climate and nature disclosures – risks and opportunities

- Calculation of all emissions (by scope and by component category), energy and water consumption and other sustainability indicators

- Calculation of all nature and biodiversity metrics and targets

- Transition planning, target setting, forward looking statements, and decarbonisation plans

- Scenario analysis – test scenarios that align with international agreements

- Product carbon footprint and life cycle assessments

- Automated reporting, data centralisation and validation, mass and energy balance, delivered in digital taxonomy (Xbrl), fully auditable, immutable and traceable.

ST offers robust capabilities to handle intricacies, enabling the tracking and documentation of activity data – including categorisation by country, site, site boundaries, scope, reporting category (such as fuels, reagents, waste, energy, and water), and even at the level of individual products.

Detailed and auditable reports provide the flexibility needed to monitor operational changes, such as shifts in processes, supplier relationships, evolving regulatory frameworks, and the capacity to conduct materiality assessments for key sustainability disclosures. Beyond mere regulatory adherence, these insights empower you to optimise productivity, efficiency, environmental impact, and financial performance.

Having undergone rigorous testing since 2010 across diverse industrial settings, spanning nine countries and available in four languages, ST is as a proven, smart solution for achieving sustainability compliance and ensuring precise reporting.

ST can also deeply integrate with other existing systems to contribute to complete any specific ESG reporting requirements that your organisation may have. You can connect your production reporting, to your sustainability reporting and link them all to your financial reporting—creating a direct relationship that removes the pressure and complexity to keep up with multiple evolving frameworks with different rules and regulations across jurisdictions.

All the data and information from ST can also inform your financial statements. For example, actual production, inventory, planning and budgeting, carbon offsets, carbon tax, capital investment (to meet decarbonisation targets), recycling (virgin or recycled feed influence production costs), cost of waste processing, and employee remuneration linked to sustainability outcomes.

All these metrics that inform the financial statements can also be reconciled and traced back to source data from ST.

#10. From Excel to Sustainability Tracker: How to make the shift

The experienced team at Industrial Sustainability Solutions can help your organisation make a seamless and rapid switch from Excel spreadsheets to Sustainability Tracker.

The process involves three broad steps.

Step 1: Initial feasibility study

Before we can begin optimising your sustainability reporting, we first take the time to understand—in detail— the specific frameworks and metrics which need to be reported. We research which global frameworks and regulations apply to your organisation; map any mandatory or voluntary sustainability indicators which need to be measured; and identify all the data that is required across the value chain.

We then assess your existing technology and data— conducting an audit of your digital tools, data sources and use of automation at every stage of your business’ operations, including along your supply chain (upstream and downstream).

This involves determining what data is being collected (and which is available and missing); what digital systems and instrumentation is needed to measure activity data, consumption, movements in inventory and emissions, and noting any other sustainability metrics across the entire value chain.

Step 2: Solution implementation

Once we understand the scope of your reporting requirements, and the tools and processes you currently use, we can start implementing a new, digital solution.

This involves several important steps:

Automating asset-wide data processes using machine learning

The first step is to bring together (and digitalise) industrial asset data from multiple sources across your organisation, into a single source of truth. The data needs to be both interoperable and fully traceable, so any issues or anomalies can be readily detected. Information also needs to be sourced from a range of different instruments or departments, and include data from financial systems. By automating this data collection, you significantly reduce the risk of error and support much greater volumes of data.

Data validation

After centralising asset-wide data, the data is organised and validated using machine learning to ensure data quality. This occurs throughout several steps of the data collection process.

Digital simulation of processes

Using all of the source data that we have just centralised, organised and validated, we then perform a mass and energy balance of your entire production process using dynamic simulation. This involves measuring your inventory using time as a dimension, tracking intermediate streams, and cross-checking measured data with simulated calculated data for context and accuracy. This process delivers contextualised data at the levels required for sustainability reporting.

Categorise and tag data sets

We then assign a scope, boundary, category and data type to each validated data stream to help us determine the most accurate activity data throughout the industrial process.

Calculate process-wide activity data

The next step involves digitally calculating activity data for every country, site, site boundary, scope and reporting category (e.g., fuels, reagents, waste, energy and water) as well as data type by each individual product.

Assign emissions factors and calculate CO2 equivalents

Once the required activity data has been calculated, the next step is to assign the appropriate emissions factors. Our solution can connect to internationally recognised third-party databases such as the US EPA, eGRID, DEFRA, and country electricity factors from the IEA to use their emissions factors when calculating sustainability indicators for supplier-specific and custom emissions factors.

Step 3: Activation and ongoing improvements

Once your solution is implemented, you can start to report on your emissions and other sustainability and nature-related indicators. With access to accurate, granular and traceable data, near real-time reports can be generated to meet the demands of evolving global industrial standards and rules. Our solution is designed to be compliant with, and easily adapt to, diverse regulations and governance frameworks and requirements across different sites and countries as well as immediately capturing changes in sustainability indicators caused by any variations in the production process across the supply chain.

Importantly, you can also now set and meet targets to reduce emissions and improve on your sustainability metrics by:

- Creating transition plans that can be independently verified and quantified using robust metrics detailing targets, offsets and mitigation strategies.

- Producing climate and nature resilience assessments that include future state scenario analysis, and what these scenarios mean in terms of the financial and nature impacts to the business operations.

Step 4: Training and support

Our expert team will also provide both on-site and virtual training, as well as ongoing technical support, to ensure you get the most out of your solution.

Start your transition to best practice sustainability reporting today

To explore how Sustainability Tracker can help create transparent, consistent and complete sustainability reports that comply with across multiple emerging and evolving frameworks, contact our expert team on +61 2 7229 5662 or info@industrialsustainabilitysolutions.com

About Industrial Sustainability Solutions

Industrial Sustainability Solutions (ISS) is the world-leading Australian technology company behind Sustainability Tracker (ST), a proven industrial sustainability analytics and reporting platform designed for complex industrial processes.

ISS is founded and run by the established team behind Metallurgical Systems. Since 2010, Metallurgical Systems has enabled accurate and transparent production reporting and finance grade sustainability reporting for minerals and mining plants globally.

Our award-winning digital twin technology is built on a decade of experience streamlining industrial plants worldwide. Proven in 9 countries and in 4 languages, this gold standard approach to sustainability tracking and reporting is now available for all complex industrial operations and it’s ready to deploy today.

Start your transition to best practice sustainability reporting today

To explore how Sustainability Tracker can help create transparent, consistent and complete sustainability reports that comply with across multiple emerging and evolving frameworks, contact our expert team on +61 2 7229 5662 or info@industrialsustainabilitysolutions.com

About the Authors

This article has been collaboratively authored by the Industrial Sustainability Solutions team and fact-checked and authorised by Managing Director and industry specialist John Vagenas.

References

- McKinsey, Outcomes from COP28

- United Nations Climate Change, New analysis of national climate plans: insufficient progress made

- Our world in data, Emissions by Sector

- Industrial Sustainability Solutions, Industrial Sustainability Reporting

- Industrial Sustainability Solutions, Industrial Sustainability Reporting

- EY, How finance professionals are helping to advance ESG reporting

- EY, How finance professionals are helping to advance ESG reporting

- EY, Can robust sustainability reporting sprout from better use of technology?

- EY, How finance professionals are helping to advance ESG reporting

- EY, How finance professionals are helping to advance ESG reporting

- EY, How finance professionals are helping to advance ESG reporting

- EY, How finance professionals are helping to advance ESG reporting

- EY, How finance professionals are helping to advance ESG reporting

- Deloitte, Challenges and solutions: Scope 3 emissions

- IBM, ESG Data Conundrum

- EY, How finance professionals are helping to advance ESG reporting

- EY, How finance professionals are helping to advance ESG reporting

- BMG, Use AI to Measure Emissions—Exhaustively, Accurately, and Frequently

- BMG, Use AI to Measure Emissions—Exhaustively, Accurately, and Frequently

- IBM, The ESG Data Conundrum

- World Economic Forum, How digital solutions can reduce global emissions

- IBM, ESG Data Conundrum

- IBM, ESG Data Conundrum

- IBM, ESG Data Conundrum